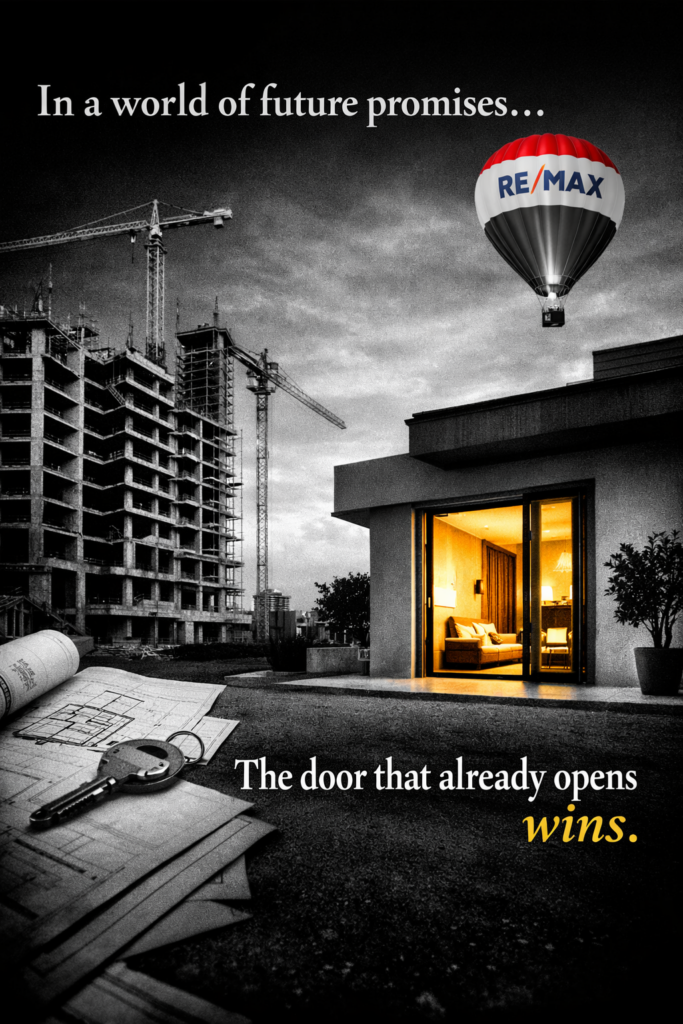

For years, off-plan was the hero of the story.

Flexible payment plans. Glossy renders. Future promises wrapped in optimism.

And yet—this cycle—the market has developed a sense of timing.

Buyers are no longer applauding the idea of eventual.

They are gravitating toward now.

Vacant-ready units are closing faster.

Negotiations are cleaner.

Decision-making is calmer.

Not because off-plan is wrong.

But because certainty has quietly become fashionable again.

In an environment where buyers are more informed, more cautious, and far less impressed by speculative upside alone, immediate usability carries weight.

Keys matter.

Visibility matters.

Knowing exactly what you are buying matters.

Off-plan transfers are still transacting—but with hesitation, longer consideration periods, and sharper questions.

Vacant-ready stock, meanwhile, does not need a narrative. It simply exists. And performs.

This is not a panic shift.

It is not fear-driven.

It is a market expressing maturity.

When volatility increases, drama fades.

Practicality steps forward.

And suddenly, the most attractive feature is not a future promise—but a door that already opens.

The market always tells the truth.

Just not loudly.