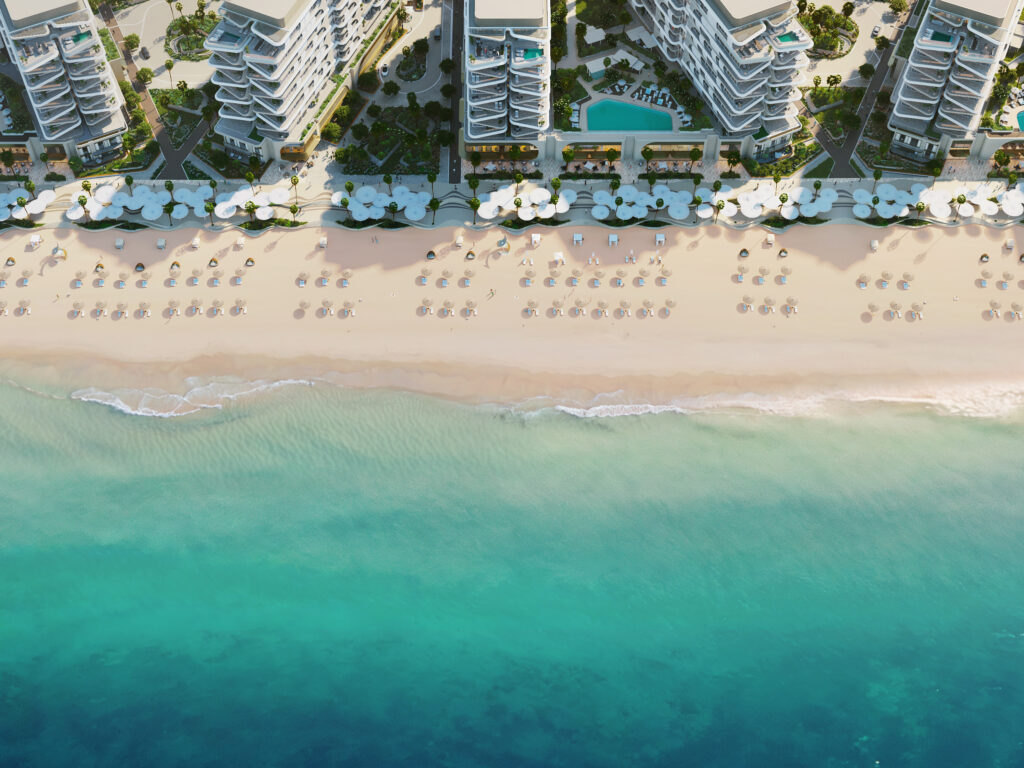

🌍 Dubai is not just building towers… it’s creating new destinations.

And Dubai Islands is one of the most ambitious.

As of 2025, the transformation is real:

✅ 3 hotels already operational RIU (800 keys), Centara Mirage (607 keys), Park Regis (159 keys).

✅ RTA awarded an AED 786M contract for an 8-lane bridge linking Bur Dubai to Dubai Islands.

✅ Nakheel communities under development: Bay Villas (636 homes), Beach Residences (handover 2026), Nautis Residences (63 boutique units), Bay Grove phases (some completing around 2029).

The masterplan vision: ~28,500 homes and 87 hotels across 5 themed islands.

But what about the numbers?

• Pre-handover resales: typically see +10–15% uplift if demand is strong.

• At handover: completed units often re-price +15–22% once banks open mortgages.

• 5 years out: projections suggest +40–50% appreciation if infrastructure and demand align.

• 10 years: long-range models show +80–100% uplift in line with Dubai 2040’s urban growth.

⚠️ Yet, caution is needed. Fitch warns of a potential 15% correction in 2026 due to heavy supply. Property Monitor already recorded a small dip (–0.57% in Jan 2025). Experts like Knight Frank forecast ~5% growth this year in prime markets far more modest.

The truth? Dubai Islands is a legacy play. Smart investors balance premium capital growth here with yield assets in mainland communities (like Imtiaz projects at 7–9% gross in JVC/Meydan).

📞 Ready to position yourself early in Dubai’s next waterfront icon? Call me directly at +971 50 442 4969.

hashtag#DubaiIslands hashtag#DubaiRealEstate hashtag#Investment2025 hashtag#PropertyInvestment hashtag#Nakheel hashtag#Dubai2040

REMAX Knight Frank Savills Middle East REMAX UAE THINKPROP

- Home

- Explore Properties

- Off Plan Projects

- Partner with us

- About Us

- Blogs

- PREAD

- Directory of UAE

- Introduction & Federal Vision

- Each Emirate’s Vision & Identity

- Regulation & Transparency

- Taxation & Finance

- Residency & Citizenship

- Education & Healthcare

- Infrastructure & Mobility

- Sustainability & Smart Cities

- Culture & Entertainment

- Business & Investment Infrastructure

- Real Estate Investment & Ownership

- Legal & Wealth Planning

- Market Data & Demographics

- Risk & Compliance

- Investor Opportunities by Theme

- Practical Information

- Financial Instruments & Digital Assets

- Strategic Sectors & Outbound

- Government & Future Agenda

- Appendices

- Macroeconomic & Risk Stability

- Market Data & Forecasts (2025 – 2030)

- Developer Performance Matrix & Delivery Reliability

- Exit & Wealth Transfer Strategies

- HNWI Lifestyle & Private Services

- ESG, Sustainability & Future Growth Corridors (2026 – 2035)

- Global Tax Comparison for Real Estate Investors

- UAE vs Saudi Arabia – Strategic Comparative Investment Outlook (2025-2035)

- Risk Scenarios (Bull / Base / Bear) – UAE Outlook 2025–2035

- Currency, Hedging & Capital Flow

- Banking, SPV & Offshore Structures

- Investor Entry Paths by Country

- Micro-Market Benchmarking – UAE

- Institutional Capital & REIT Markets (UAE)

- Sharia-Compliant Investment Structures (UAE Context)

- Summary, Sources & Methodology

- Section 37

- Directories of Cyprus

- Republic of Cyprus – Country Snapshot, Geography & National Context

- Administrative Structure & City Framework of Cyprus

- Legal Framework, Ownership Rights & Title Deeds in Cyprus

- Taxes, Fees & Transaction Costs in Cyprus

- Residency, Permanent Residency & NonDom Status in Cyprus

- Cyprus Real Estate Market Overview & Historical Cycles

- City-by-City Price Benchmarks, Rental Yields & Micro-Area Intelligence

- Infrastructure, Transport, Energy & National Development Projects

- Education System, Universities & Healthcare Infrastructure

- Lifestyle, Cost of Living, Safety & Quality of Life

- Property Buying Process in Cyprus – Stepby-Step Framework

- Investment Strategies, Risk Profiles & Use Case Scenarios

- ESG, Sustainability, Climate Risk & LongTerm Resilience

- Portfolio Structuring, Allocation Models & Scenario Planning

- Banking, Mortgages & Financing Environment

- Rental Regulations, Licensing & Property Management

- Risk Register & Investor Suitability Framework

- Section 18