Real Estate Is Not Property. It Is a Probability Model.

Most people think real estate is about property.

Buildings.

Land.

Apartments.

Square meters.

They are wrong.

Property is static.

Real estate is a living system.

And every city is governed by mathematics long before it is shaped by architecture.

A city does not grow randomly.

It follows invisible equations:

• Population flows

• Infrastructure gravity

• Employment density

• Capital migration

• Regulatory vectors

• Lifestyle behavior

Before a tower rises, the data already knows it will exist.

Before a district becomes “prime”, the probability was already written.

What investors call “a good location” is actually:

A probability cluster.

The probability that:

• people will move there

• companies will hire there

• governments will invest there

• banks will finance there

• families will settle there

• capital will circulate there

Real estate is not property.

Real estate is applied urban economics.

It is the intersection of:

• Law

• Infrastructure

• Demographics

• Capital

• Behavior

• Time

Bound together by mathematics.

Every project is a probability curve.

Every master plan is a demand forecast.

Every zoning code is a future price map.

And every investor decision is a bet on:

where people will want to live before they know it themselves.

The most powerful investors do not buy buildings.

They buy:

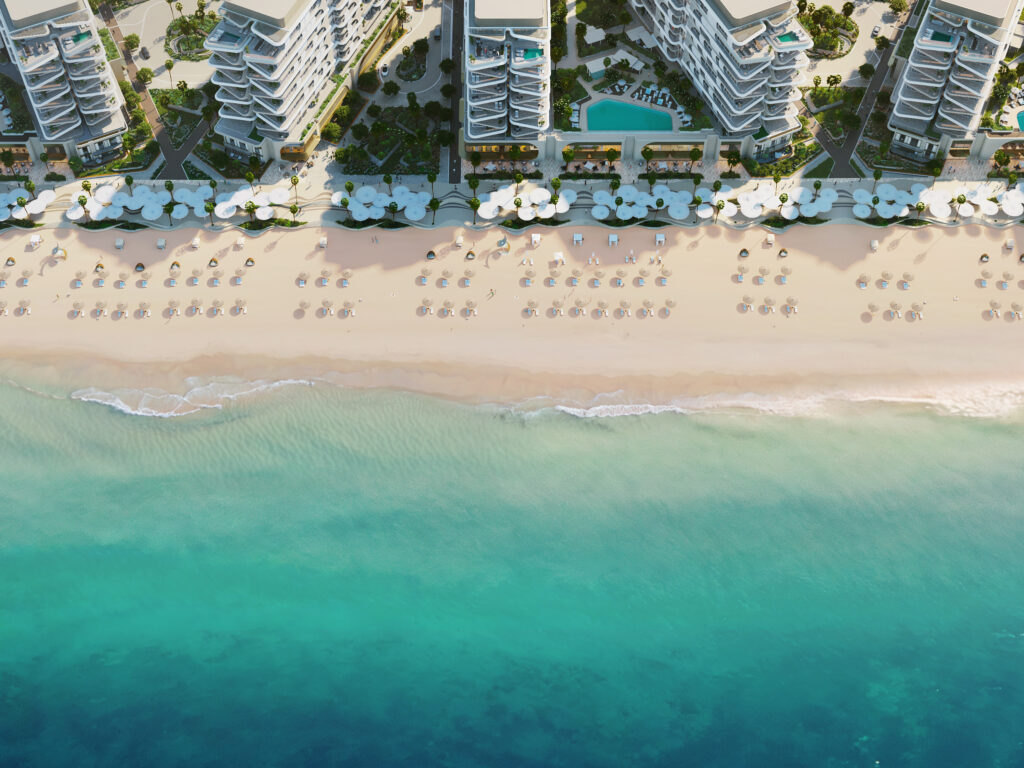

• transport lines before they open

• districts before they trend

• waterfronts before they activate

• growth corridors before they densify

They don’t predict cities.

They position inside them.

This is why two identical apartments can have completely different futures.

Because real estate is not about the unit.

It is about:

• what is being built around it

• who is moving near it

• which roads are touching it

• which laws protect it

• which capital flows feed it

Cities are not concrete.

Cities are algorithms.

And real estate is the interface between human behavior and capital logic.

If you understand this, you stop asking:

“Is this a nice property?”

And start asking:

“What is the probability this location will outperform the city?”

That question alone separates brokers from strategists.

The future of real estate will not belong to agents.

It will belong to:

• data readers

• city modelers

• infrastructure analysts

• probability engineers

Those who understand that wealth is not created by buildings.

It is created by timing urban gravity.

I don’t sell property.

I study cities.

And I invest where mathematics tells me people will arrive next.

Urban economics. Real estate intelligence. City probability.

This becomes your intellectual brand.

hashtag#UrbanEconomics

hashtag#ArchitectureOfRealEstate

hashtag#FutureOfCities

hashtag#CapitalMarkets

hashtag#InfrastructureEconomy

hashtag#RealEstateIntelligence

hashtag#CityProbability

UN-Habitat (United Nations Human Settlements Programme)

- Home

- Explore Properties

- Off Plan Projects

- Partner with us

- About Us

- Blogs

- PREAD

- Directory of UAE

- Section 1

- Section 2

- Section 3

- Section 4

- Section 5

- Section 6

- Section 7

- Section 8

- Section 9

- Section 10

- Section 11

- Section 12

- Section 13

- Section 14

- Section 15

- Section 16

- Section 17

- Section 18

- Section 19

- Section 20

- Section 21

- Section 22

- Section 23

- Section 24

- Section 25

- Section 26

- Section 27

- Section 28

- Section 29

- Section 30

- Section 31

- Section 32

- Section 33

- Section 34

- Section 35

- Section 36

- Section 37

- Directories of Cyprus